Author: 梧桐

Recently, China Unicom and Yuanyuan Communication respectively launched high-profile 5G RedCap module products, which attracted the attention of many practitioners in the Internet of Things. And according to relevant sources, other module manufacturers will also be released in the near future similar products.

From an industry observer’s point of view, the sudden release of 5G RedCap products today looks a lot like the launch of 4G Cat.1 modules three years ago. With the release of 5G RedCap, we wonder if the technology can replicate the miracle of Cat.1. What are the differences in their development backgrounds?

The next year it shipped over 100 million

Why is the Cat.1 market called a miracle?

Although Cat.1 was developed in 2013, it wasn’t until 2019 that the technology was commercialized on a large scale. At that time, major module manufacturers such as Yuanyuan Communication, Guanghetong, Maigue Intelligence, Youfang Technology, Gaoxin Internet of Things, etc. entered the market one after another. By planning module products for different application scenarios, they opened the Chinese market of Cat.1 in 2020.

The huge market cake has also attracted more communication chip manufacturers, in addition to Qualcomm, Unigroup Zhanrui, Optica Technology, more mobile core communication, core wing information, Zhaopin and other new entrants.

It is understood that since the collective release of Cat.1 products by each module manufacturer in 2020, the domestic module product shipments exceeded 20 million within a year. During this period, China Unicom directly collected 5 million sets of chips, pushing the large-scale commercial use of Cat.1 to a new height.

In 2021, Cat.1 modules shipped 117 million units worldwide, with China taking the largest market share. However, in 2022, due to the repeated impact of the epidemic on the supply chain and application market, the overall shipment of Cat.1 in 2022 did not grow as expected, but there were still about 100 million shipments. As for 2023, according to the relevant data forecast, Cat.1 shipments will maintain a 30-50% growth.

For the communication technology applied in the Internet of things industry, the volume and growth rate of Cat.1 products can be said to be unprecedented. Compared with 2G/3G or the popular NB-IoT in recent years, the latter three products failed to ship over 100 million yuan in such a short time.

While everyone is watching Cat.1 explode in demand and the supply side make a lot of money, the cellular Internet of Things market is also more promising. For this reason, as an inevitable technology iteration, 5G RedCap technology is expected to be more.

If RedCap wants to copy the miracle

What is possible and what is not?

In the Internet of Things industry, the release of module products usually means that the terminal products will be commercialized. Because in the fragmented application scenario of the Internet of Things, terminal devices and solutions rely more on module products to reprocess chips, so as to ensure the suitability of products to applications. For the long-held 5G RedCap, whether it can usher in the market outbreak is widely concerned by the industry.

To see if RedCap can replicate the magic of Cat.1, you need to compare the two in three ways: performance and scenarios, context, and cost.

Performance and application scenarios

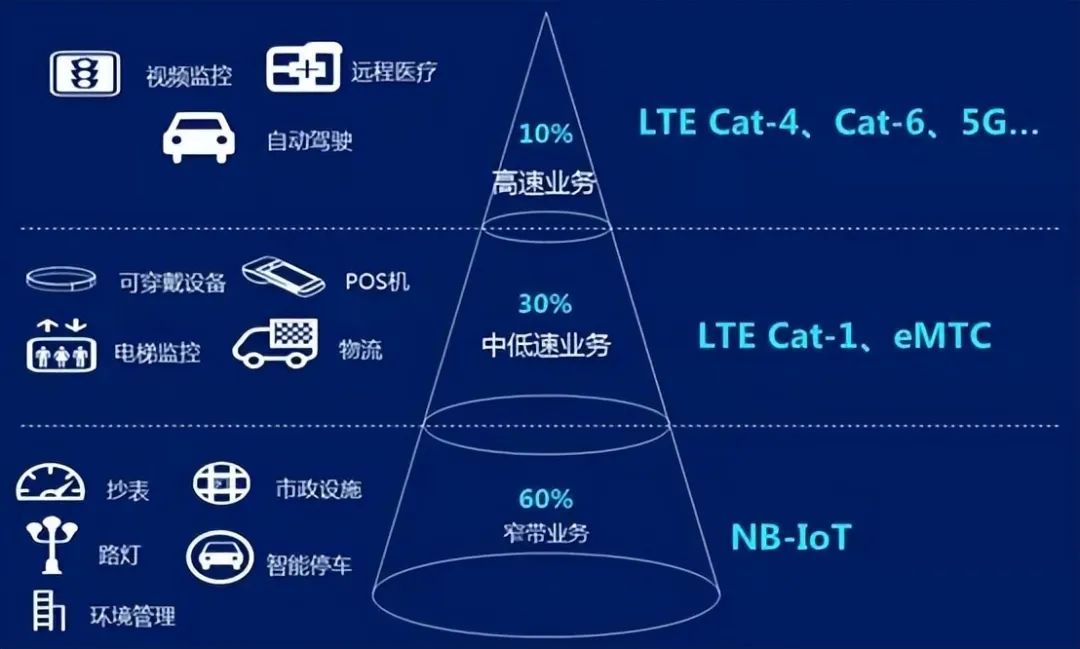

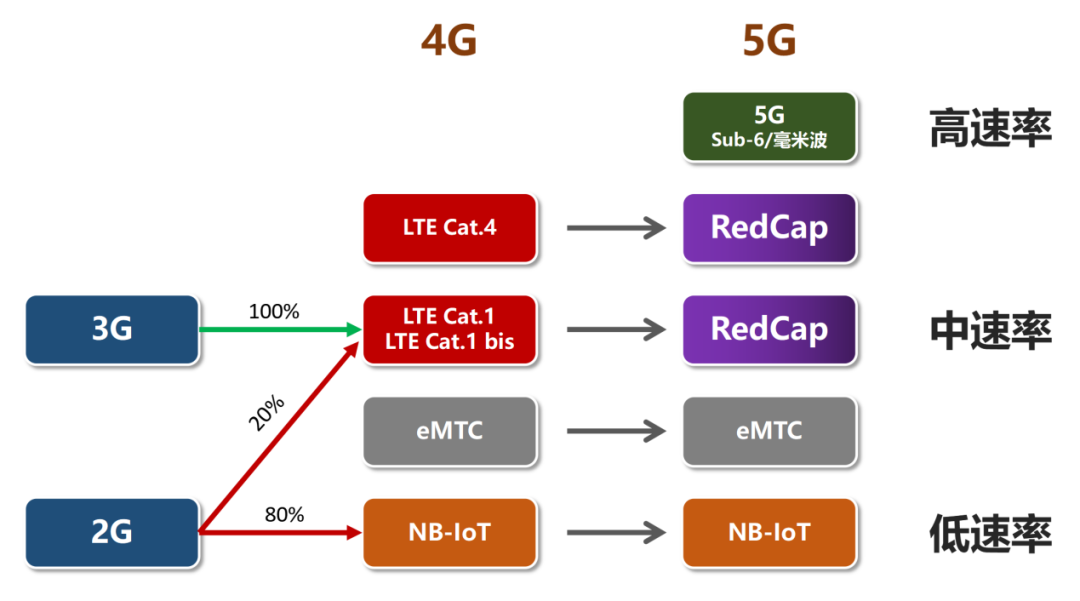

It is well known that 4g catis are low-distribution versions of 4g, while 5g redcap is a low distribution of 5g. The goal is that the powerful 4gg 5g is a waste of the use of low power and low power costs in many things, equivalent to “using artillery to fight mosquitoes.” So, the low-scale technology will be able to match more Internet scenes.The relationship between redcap and cat-is the former, and the future in the medium and low speed Internet scenario, including logistics, wearable equipment, and other applications of the device, will be iterative. In other words, from the performance of the technology and the adaptation of the scene, redcap has the power to replicate the cat-specific signs.

General background

Looking back, it is not difficult to find that the rapid growth of Cat.1 is actually under the background of 2G/3G offline. In other words, the huge stock replacement provided a large market for Cat.1. However, for RedCap, the historical opportunity is not as good as Cat.1, because the 4G network is just mature and the time to decommission is still far away.

On the other hand, in addition to 2G/3G network withdrawal, the whole 4G network development including infrastructure is very mature, is now the best coverage of cellular network, operators do not need to build additional networks, so there will be no significant resistance to promotion. Looking at RedCap, the coverage of the current 5G network itself is not perfect, and the construction cost is still high, especially in areas where the traffic is not very dense are on-demand deployment, which leads to the imperfect network coverage, it will be difficult for many applications to support the choice of the network.

So from a background perspective, RedCap has a hard time replicating Cat.1′s magic.

Cost

It is understood that in terms of price, the initial commercial price of RedCap module is expected to be 150-200 yuan, after large-scale commercial, it is expected to be reduced to 60-80 yuan, and the current Cat.1 module only needs 20-30 yuan.

Meanwhile, in the past, Cat.1 modules have been brought down to an affordable price quickly after launch, but RedCap will find it difficult to reduce costs in the short term, given the lack of infrastructure and low demand.

In addition, in the chip level, Cat.1 upstream of the domestic players such as Unigroup Zhanrui, Optica Technology, Shanghai Mobile Chip, very friendly in terms of price. At present, RedCap is still based on Qualcomm chips, the price is relatively expensive, until domestic players also launch corresponding products, the cost of RedCap chips is difficult to reduce.

So, from a cost perspective, RedCap doesn’t have the advantages that Cat.1 has in the near term.

Look into the future

How did RedCap take root?

Throughout the years of development of the Internet of Things, it is not difficult to find that there is not and will not be a one-size-fits-all technology in the industry, because the fragmentation of application scenarios determines the diversification of hardware devices.

Cellular manufacturers are successful and make a lot of money because of their role in connecting the upstream and downstream. For example, the same chip can be transformed into dozens of products after modularization, and each product can enable dozens of terminal devices, which is the underlying logic of Internet of Things communication.

So RedCap, which appears for the Internet of Things, will slowly penetrate into the corresponding scene in the near future. At the same time, the technology will continue to iterate and the market will continue to evolve. RedCap provides a new technology choice for Internet of Things applications. In the future, when an application most suitable for RedCap appears, its market will explode. At the terminal level, RedCap-supported network devices will be commercially piloted in 2023, and mobile terminal products will be commercially piloted in the first half of 2024.

Post time: Mar-07-2023