According to the recently released Industrial AI and AI Market Report 2021-2026, the adoption rate of AI in industrial Settings increased from 19 percent to 31 percent in just over two years. In addition to 31 percent of respondents who have fully or partially rolled out AI in their operations, another 39 percent are currently testing or piloting the technology.

AI is emerging as a key technology for manufacturers and energy companies worldwide, and IoT analysis predicts that the industrial AI solutions market will show a strong post-pandemic compound annual growth rate (CAGR) of 35% to reach $102.17 billion by 2026.

The digital age has given birth to the Internet of Things. It can be seen that the emergence of artificial intelligence has accelerated the pace of the development of the Internet of Things.

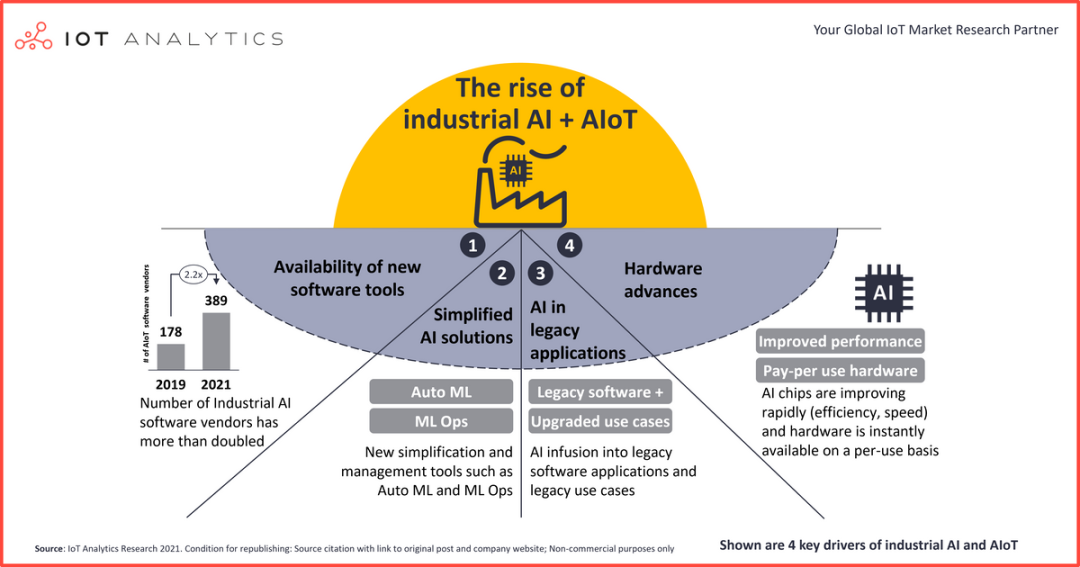

Let’s take a look at some of the factors driving the rise of industrial AI and AIoT.

Factor 1: More and more software tools for industrial AIoT

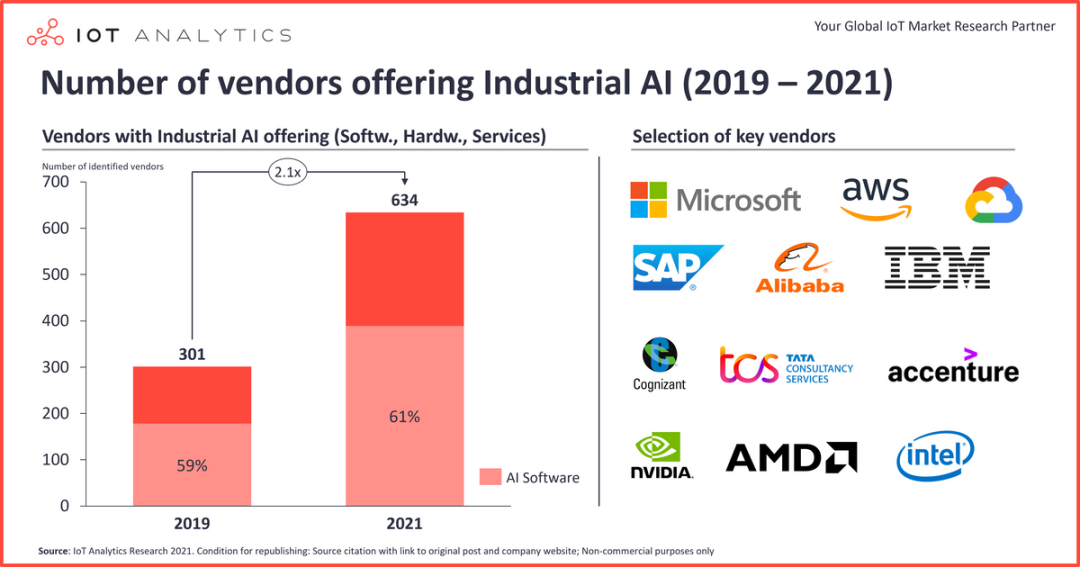

In 2019, when Iot analytics began to cover industrial AI, there were few dedicated AI software products from operational technology (OT) vendors. Since then, many OT vendors have entered the AI market by developing and providing AI software solutions in the form of AI platforms for the factory floor.

According to data, nearly 400 vendors offer AIoT software. The number of software vendors joining the industrial AI market has increased dramatically in the past two years. During the study, IoT Analytics identified 634 suppliers of AI technology to manufacturers/industrial customers. Of these companies, 389 (61.4%) offer AI software.

The new AI software platform focuses on industrial environments. Beyond Uptake, Braincube, or C3 AI, a growing number of operational technology (OT) vendors are offering dedicated AI software platforms. Examples include ABB’s Genix Industrial analytics and AI suite, Rockwell Automation’s FactoryTalk Innovation suite, Schneider Electric’s own manufacturing consulting platform, and more recently, specific add-ons. Some of these platforms target a wide range of use cases. For example, ABB’s Genix platform provides advanced analytics, including pre-built applications and services for operational performance management, asset integrity, sustainability and supply chain efficiency.

Big companies are putting their ai software tools on the shop floor.

The availability of ai software tools is also driven by new use-case specific software tools developed by AWS, large companies such as Microsoft and Google. For example, in December 2020, AWS released Amazon SageMaker JumpStart, a feature of Amazon SageMaker that provides a set of pre-built and customizable solutions for the most common industrial use cases, such as PdM, computer vision, and autonomous driving, Deploy with just a few clicks.

Use-case-specific software solutions are driving usability improvements.

Use-case-specific software suites, such as those focused on predictive maintenance, are becoming more common. IoT Analytics observed that the number of providers using AI-based product data management (PdM) software solutions rose to 73 in early 2021 due to an increase in the variety of data sources and the use of pre-training models, as well as the widespread adoption of data enhancement technologies.

Factor 2: The development and maintenance of AI solutions are being simplified

Automated machine learning (AutoML) is becoming a standard product.

Due to the complexity of the tasks associated with machine learning (ML), the rapid growth of machine learning applications has created a need for off-the-shelf machine learning methods that can be used without expertise. The resulting field of research, progressive automation for machine learning, is called AutoML. A variety of companies are leveraging this technology as part of their AI offerings to help customers develop ML models and implement industrial use cases faster. In November 2020, for example, SKF announced an automL-based product that combines machine process data with vibration and temperature data to reduce costs and enable new business models for customers.

Machine learning operations (ML Ops) simplify model management and maintenance.

The new discipline of machine learning operations aims to simplify the maintenance of AI models in manufacturing environments. The performance of an AI model typically degrades over time as it is affected by several factors within the plant (for example, changes in data distribution and quality standards). As a result, model maintenance and machine learning operations have become necessary to meet the high quality requirements of industrial environments (for example, models with performance below 99% May fail to identify behavior that endangers worker safety).

In recent years, many startups have joined the ML Ops space, including DataRobot, Grid.AI, Pinecone/Zilliz, Seldon, and Weights & Biases. Established companies have added machine learning operations to their existing AI software offerings, including Microsoft, which introduced data drift detection in Azure ML Studio. This new feature enables users to detect changes in the distribution of input data that degrade model performance.

Factor 3: Artificial intelligence applied to existing applications and use cases

Traditional software providers are adding AI capabilities.

In addition to existing large horizontal AI software tools such as MS Azure ML, AWS SageMaker, and Google Cloud Vertex AI, traditional software suites such as Computerized Maintenance Management Systems (CAMMS), Manufacturing execution systems (MES) or enterprise resource planning (ERP) can now be significantly improved by injecting AI capabilities. For example, ERP provider Epicor Software is adding AI capabilities to its existing products through its Epicor Virtual Assistant (EVA). Intelligent EVA agents are used to automate ERP processes, such as rescheduling manufacturing operations or performing simple queries (for example, obtaining details about product pricing or the number of available parts).

Industrial use cases are being upgraded by using AIoT.

Several industrial use cases are being enhanced by adding AI capabilities to existing hardware/software infrastructure. A vivid example is machine vision in quality control applications. Traditional machine vision systems process images through integrated or discrete computers equipped with specialized software that evaluates predetermined parameters and thresholds (e.g., high contrast) to determine whether objects exhibit defects. In many cases (for example, electronic components with different wiring shapes), the number of false positives is very high.

However, these systems are being revived through artificial intelligence. For example, industrial machine Vision provider Cognex released a new Deep Learning tool (Vision Pro Deep Learning 2.0) in July 2021. The new tools integrate with traditional vision systems, enabling end users to combine deep learning with traditional vision tools in the same application to meet demanding medical and electronic environments that require accurate measurement of scratches, contamination and other defects.

Factor 4: Industrial AIoT hardware being improved

AI chips are improving rapidly.

Embedded hardware AI chips are growing rapidly, with a variety of options available to support the development and deployment of AI models. Examples include NVIDIA’s latest graphics processing units (Gpus), the A30 and A10, which were introduced in March 2021 and are suitable for AI use cases such as recommendation systems and computer vision systems. Another example is Google’s fourth-generation Tensors Processing Units (TPus), which are powerful special-purpose integrated circuits (ASics) that can achieve up to 1,000 times more efficiency and speed in model development and deployment for specific AI workloads (e.g., object detection, image classification, and recommendation benchmarks). Using dedicated AI hardware reduces model computation time from days to minutes, and has proven to be a game changer in many cases.

Powerful AI hardware is immediately available through a pay-per-use model.

Superscale enterprises are constantly upgrading their servers to make computing resources available in the cloud so that end users can implement industrial AI applications. In November 2021, for example, AWS announced the official release of its latest GPU-based instances, Amazon EC2 G5, powered by the NVIDIA A10G Tensor Core GPU, for a variety of ML applications, including computer vision and recommendation engines. For example, detection systems provider Nanotronics uses Amazon EC2 examples of its AI-based quality control solution to speed up processing efforts and achieve more accurate detection rates in the manufacture of microchips and nanotubes.

Conclusion and Prospect

AI is coming out of the factory, and it will be ubiquitous in new applications, such as AI-based PdM, and as enhancements to existing software and use cases. Large enterprises are rolling out several AI use cases and reporting success, and most projects have a high return on investment. All in all, the rise of the cloud, iot platforms and powerful AI chips provides a platform for a new generation of software and optimisation.

Post time: Jan-12-2022